Bank Of Canada Interest Rate

Bank of Canada governor Tiff Macklem has faced pressure to raise interest rates to stave off inflation but hiking interest rates risks limiting Canadas economic growth. The 50 basis point cut brings the overnight rate to 125 per cent.

Central Bank Rates Worldwide Interest Rates Bank Of Canada Boc

If youre planning to borrow to finance a large purchase such as a new home or vehicle the current interest rate determines how much it will.

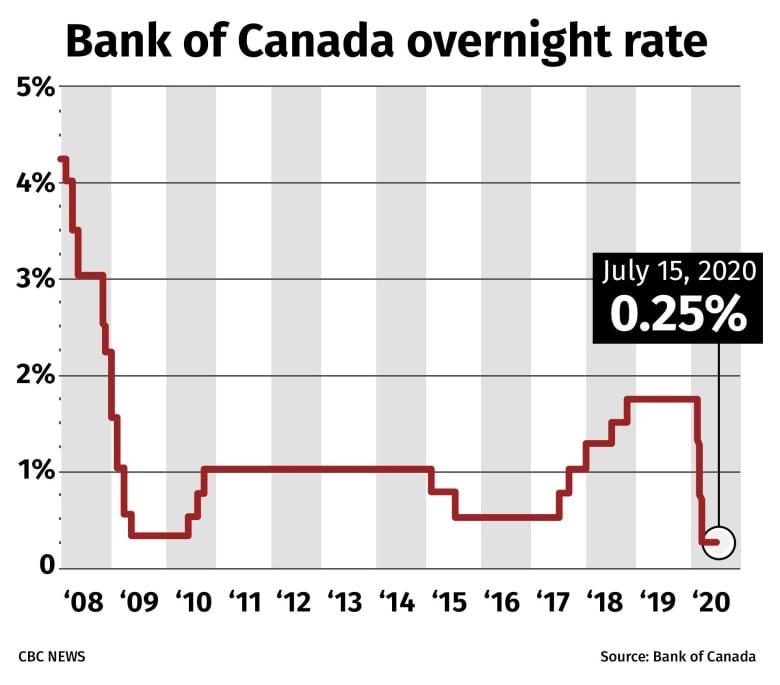

Bank of canada interest rate. Despite widespread economic growth 2018 and 2019 were marked by continued low inflation preventing the Bank of Canada from raising rates any higher than 175. The Bank of Canada surprised investors by abruptly ending its bond-buying programme on Wednesday and pulling forward its expected timeline for interest rate rises triggering a heavy sell-off in. Prospective homebuyers were reassured today that interest rates will remain near historic lows for a long time according to Bank of Canada Governor Tiff Macklem.

Every panellist 100 believes the Bank of Canada will hold the rate July 14. Long-term government bond rates have risen from 03 to 10 since January. Before the outbreak the global economy was showing signs of stabilizing as the Bank had.

The BoC chief made the comments during a conference call following the Banks interest rate meeting where it left the overnight lending rate unchanged at 025 at its effective lower bound. These can include credit cards HELOCs variable-rate. The Bank of Canadas next interest rate decision is scheduled for Oct.

Stay up to date with BOC interest rate news. During that time there was speculation around a further rate cut or even negative rates to stimulate the economy but in recent reports the Bank of Canada has provided clear forward guidance stating the interest rate will hold until inflation targets have been met likely in about a year. Canadas central bank is ending its bond-buying program which was intended to battle the pandemic and stimulate the economy.

If youre a saver the prevailing interest rate affects how much your savings earn. The Bank of Canada is warning inflation will stay higher for longer than it previously forecast and signalled that an interest rate hike may be coming sooner than expected. The Bank of Canada says the domestic economy will grow at a slightly slower pace this year than it previously thought and expects the risks from COVID-19 to wane -.

Heres the official statement from the Bank of Canadas interest rate decision on Wednesday Oct. Canadas central bank is keeping its benchmark policy interest rate right where it is but is signalling that higher rates are coming soon. The Bank of Canada cut its key benchmark interest rate by 50 basis points Wednesday morning over concerns about what the coronavirus could do to the economy.

Prime Rates in Canada. So with this transparency its no surprise every single panellist out of the 15 respondents on. 27 when it will also update its outlook for the economy and inflation in its fall monetary policy report.

This advertisement has not loaded yet but your article continues below. Housing forecasted to increase at a national average of 4 in. The central bank is currently purchasing government bonds at a rate of 2 billion per week.

This has a knock-on effect on mortgage rates which have risen roughly half a percent. This was quickly reversed with the impact of COVID-19 with a two 50 basis. The Prime rate in Canada is currently 245.

The Bank of Canada BOC is Canadas central bank and determines the monetary policy path and dictates interest rates. Most economists 78 believe there will be some political or economic risk to ending pandemic emergency support programs. Majority of economists 74 believe the rate will hold until second half 2022.

The Bank of Canada keeps overnight rate at effective lower bound and maintains QE program. However the bank signalled that interest rates could rise in the second half of 2022. Policymakers continue to expect the economy to strengthen in the second half of 2021 although the fourth wave of COVID-19 infections and.

At its May announcement the Bank of Canada BoC signalled it might start raising short-term interest rates in late 2022 as a. The Bank reiterated that the interest rate would remain at its effective lower bound until economic slack is. The Bank of Canada today held its target for the overnight rate at the effective lower bound of ¼ percent with the Bank Rate at ½ percent and the deposit rate.

Thats because interest rates have an impact on all Canadians. The Bank of Canada held its target for the overnight rate at 025 on September 9th 2021 in line with forecasts and maintained the quantitative easing program at a target pace of 2 billion per week following a 1 billion cut in the previous meeting. Bank of Canada governor Tiff Macklem says the central bank plans to increase interest rates before it reduces the size of its government bond holdings although its timing on the rate.

Canadian Interest Rate Forecast to 2023. Macklem pointed to strong job growth in recent months and high. OTTAWA - The Bank of Canada is warning inflation will stay higher for longer than it previously forecast and signalled that an interest rate hike.

Bank of Canada governor Tiff Macklem says the central bank plans to increase interest rates before it reduces the size of its government bond holdings although its timing on the rate hike will depend on the economic recovery. Bank of Canada interest rate announcements always attract significant media and public attention. The Bank of Canada BOC announced Wednesday that the overnight interest rate would remain at 025 per cent until the Canadian economy recovers and stabilizes and inflation falls to two per cent.

The Bank of Canada BoC opted to keep the overnight rate at 025 while also maintaining the quantitative easing QE program to at least 2 billion of asset purchases per week. The Prime rate is the interest rate that banks and lenders use to determine the interest rates for many types of loans and lines of credit. Low Inflation and COVID-19.

The bond-buying strategy known as quantitative easing is meant to lower. The Bank of Canada rate then dropped from 125 to 075 in 2015. The Bank of Canada is ending its quantitative easing program and moving forward its timeline for potential interest rate hikes as supply chain disruptions and.

The Bank of Canadas interest rate remains at 025 per cent. In its latest policy decision the Bank of Canada opted.

Canadian Interest Rate Forecast April 2020 Mortgage Sandbox

Interest Rates Will Stay Low As Canada Faces Long Climb Out Of Covid 19 Hole Central Bank Says Cbc Ca Canada News Media

Interest Rates Are Going To Go Crazy Soon

Holding Interest Rates Steady Bank Of Canada Keeps The Door Open For A Cut The Real Economy Blog

Bank Of Canada Makes Another Emergency Cut To Interest Rate Cbc News

Bank Of Canada Stuck In Low Rate Catch 22 Juggling Dynamite

Bank Of Canada Holds Interest Rate At 1 75 Wary Of Global Slowdown Cbc News

Investors Play Chicken With Bank Of Canada As Inflation Soars Reuters

Bank Of Canada Raises Benchmark Interest Rate To 1 5 Noting Trade Tensions Cbc News

Is 2015 The Year The Bank Of Canada Finally Raises Interest Rates National Globalnews Ca

Bank Of Canada Keeps Benchmark Interest Rate At 0 5 Cbc News

Why The Bank Of Canada Could Be Among The First To Raise Interest Rates Financial Post