Bank Of Canada Tapering April

The Bank of Canada left the overnight rate unchanged as expected. The Bank of Canada will taper its asset purchase programme again next quarter and raise interest rates earlier than previously predicted amid expectations for a robust economic recovery after a.

Bank Of Canada Tapers Quantitative Ease By 25 Rate Hikes May Come In 2022 Better Dwelling

The week of April 19 was marked by positive economic news in both the US.

Bank of canada tapering april. Policymakers last adjusted the pace of QE in April slowing the weekly purchases from C4 billion to C3 billion. They will likely cut the weekly target again by another C1 billion to C2 billion. The XM Research Desk manned by market expert professionals provides live daily updates on all the major events of the global markets in the form of market reviews forex news technical analysis investment topics daily outlook and daily vidoes.

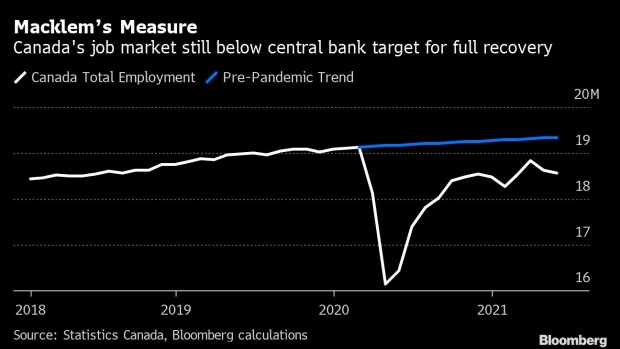

Theres speculation however they could signal plans to pare back the central banks asset purchases at the next meeting in April. The Bank of Canada BoC was the first central bank to slowly step out of its over-accommodative policy settings in late April citing the rapid improvement. More tapering on the way as markets ramp up rate hike bets In its last set of forecasts the Bank of Canada had predicted that its benchmark rate might need to be raised sometime in the second.

The bank is expected to maintain interest rates at 025 where. That means they can continue along the path of further tapering of their asset purchases and probably be at a point in late 2022 to start nudging the policy rate higher In April the Bank of Canada scaled back its weekly purchases of government debt by a quarter to C3 billion 25 billion. The Bank of Canada will announce its latest policy decision on Wednesday at 1400 GMT and is widely expected to take a step forward to lessen its stimulus.

But compared to the Bank of Canada the Fed looks like a saint. The Bank of Canada will need to keep buying at the existing pace simply to maintain its current level of asset holdings. The Bank of Canada BoC was the first central bank to slowly sail away from its super accommodative policy settings in late April citing the rapid improvement in fundamentals and the brighter economic outlook in the years ahead.

The Bank of Canada today held its target for the overnight rate at the effective lower bound of ¼ percent with the Bank Rate at ½ percent and the deposit rate at ¼ percent. Next year is a long time away from now. The Bank of Canada will taper its asset purchase programme again next quarter and raise interest rates earlier than previously predicted amid expectations for a robust economic recovery after a.

While investors are eagerly waiting to see what the next card of the tightening process could be. Bank of Canada to Stay on Tapering Path But No New. The Bank of Canada announced a couple of weeks ago citing moral hazard associated with its central bank nuttiness that it would unwind its crisis liquidity facilities and that this would reduce its total assets by about C100 billion or by about 17 from C575 billion at the time to C475 billion by the end of April.

All eyes will be on the Bank of Canada policy meeting on Wednesday 1400 GMT. Can The Bank Of Canada Pull Off A Cautious Tapering. At this point we are more focused on tapering and the timeline around that.

The Canadian dollar continues to drift this week. The Bank of Canada took the biggest step yet by a major economy to reduce emergency levels of monetary stimulus as it hailed a stronger-than-expected recovery from the pandemic. However more importantly the BoC tapered its QE purchases to C 3blnweek from the prior of C 4bln.

Will the BoC hit the taper button. In the Tuesday session USDCAD is trading at 12532 down 002 on the day. April 21 2021 Bank of Canada likely to scale down its vast QE program today Dollar breathes sigh of relief equities retreat as risk aversion returns Crude oil hit by triple whammy gold capitalizes on subdued yields BoC to take its foot off the QE gas The Bank of Canada will likely become the first major central bank.

The BoC in April said it expected inflation to temporarily hit the top of its 1-to-3 control range before returning to around 2 in the second half of the year echoing the findings of a separate Reuters poll of economists. The Bank of Canada BoC garnered headlines by becoming the first major central bank this year to. What Bloomberg Economics Says Another taper in asset purchases from the current 4 billion per week is imminent but we expect the statement to provide guidance that it is coming in April Andrew Husby economist.

The Great Exit Central Banks Line Up To Taper Emergency Stimulus Reuters

The Taper Next Door Bank Of Canada Cuts Bond Purchases By 25 Total Assets Drop By 13 Rate Hikes Moved Forward Possibly July 2022 Wolf Street

Bank Of Canada Becomes First To Signal Exit From Stimulus Bloomberg

Investors See New Round Of Canada Bond Tapering Decision Guide Bloomberg

Reuters Poll Unanimous Expecations The Bank Of Canada To Taper By Cad1bn Next Week

Bank Of England Now 2nd Central Bank To Taper After Canada But Denies Tapering Is Tapering Also Following Canada Wolf Street

Bank Of Canada Sits Tight But Expect More Tapering Article Ing Think

Bank Of Canada Holds Steady Ahead Of Possible July Taper Bnn Bloomberg

Bank Of Canada Now Owns 40 Of Government Of Canada Bonds Fed A Saint In Comparison Taper On The Table Wolf Street

Bank Of Canada Tapers Bond Buying Again Canadian Real Estate Wealth

Bank Of Canada Working Hard To Avoid A Taper Tantrum When It Eventually Slows Government Bond Purchases Financial Post

Investors Seek Clues On Bank Of Canada S Next Taper Decision Day Guide Bnn Bloomberg

Canadian Dollar Cad Surge As Taper Qe For Bank Of Canada Boc Sydney News Today

Bank Of Canada Working Hard To Avoid A Taper Tantrum When It Eventually Slows Government Bond Purchases Financial Post

Bank Of Canada Preview Pausing In September But Set To Stay On Track For More Tapering Article Ing Think

Investors Brace For Bank Of Canada Taper Decision Day Guide Bloomberg

Bank Of Canada Likely To Cut Bond Purchases Next Month Cbc News

Bank Of Canada Preview It S Taper Time But Outlook Gap Estimate Is Key